Acrobat Pro DC Cheat Sheet

Thursday, February 15 2024

Adobe Acrobat Pro DC Cheat Sheet Now Available TeachUcomp, Inc. is pleased to announce our updated Acrobat Pro DC cheat sheet, titled “Adobe Acrobat Pro DC Introduction Quick Reference Guide” is now available. Our Adobe Acrobat quick reference card helps both creative professionals and novice users. This Acrobat reference is a great tool for

- Published in Acrobat, Latest, Marketing, News, What's New at TeachUcomp?

No Comments

Excel for Microsoft 365 Training for Lawyers

Monday, January 22 2024

Excel for Microsoft 365 Training for Lawyers from TeachUcomp, Inc. TeachUcomp, Inc. is pleased to announce the release of our Excel for Microsoft 365 training for lawyers, titled “Mastering Excel Made Easy™ for Lawyers.” This tutorial provides training on using the Microsoft Excel software program for legal professionals. This comprehensive Excel for Microsoft 365

Excel for Microsoft 365 Training

Friday, January 19 2024

Excel for Microsoft 365 Training from TeachUcomp, Inc. TeachUcomp, Inc. is pleased to announce the release of our Mastering Excel Made Easy™ Excel for Microsoft 365 training tutorial. This tutorial provides training on using the Microsoft Excel software program for Microsoft 365. This comprehensive training provides 211 video lessons. It also includes a 345-page

- Published in Excel for Office 365, Latest, Marketing, Microsoft, News, Office 365, What's New at TeachUcomp?

Photoshop Elements Cheat Sheet

Friday, November 03 2023

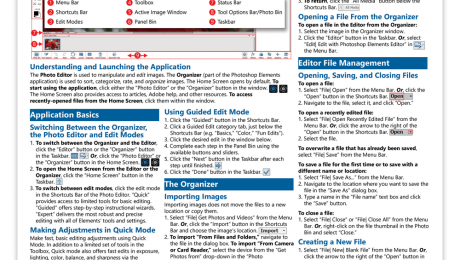

Photoshop Elements Cheat Sheet Now Available TeachUcomp, Inc. is pleased to announce our Photoshop Elements cheat sheet, titled “Photoshop Elements 2024 Introduction Quick Reference Guide” is now available. Our Photoshop Elements 2024 quick reference card helps both creative professionals and novice users. This Photoshop Elements reference is a great tool for both students and

- Published in Latest, Marketing, News, Photoshop Elements, What's New at TeachUcomp?

Sage 50 Accounting Training – Product Release

Thursday, October 26 2023

Updated Sage 50 Accounting Training 2023 Now Available: TeachUcomp, Inc. is pleased to announce an update to our Sage 50 Accounting training with the release of our new tutorial, “Mastering Sage 50 Accounting Made Easy™ v.2023.” This tutorial shows you how to use the Sage 50 Premium Accounting software. This comprehensive training provides 130

- Published in Latest, Marketing, News, Sage50, Small Business Accounting, What's New at TeachUcomp?

Excel Formulas and Functions Cheat Sheet

Friday, June 30 2023

Excel Formulas and Functions Cheat Sheet Now Available TeachUcomp, Inc. is pleased to announce our Excel formulas and functions cheat sheet, titled “Excel Formulas and Functions Quick Reference Guide” is now available. Our Excel formulas and functions quick reference card helps both new Excel users and Excel pros who just need a quick reminder. This

- Published in Excel 2016, Excel 2019, Excel 2021, Excel for Office 365, Latest, Marketing, Microsoft, News, Office 2016, Office 2019, Office 2021, Office 365, What's New at TeachUcomp?

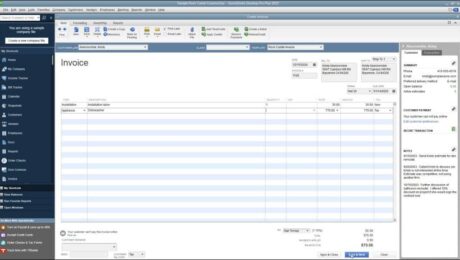

Create an Invoice in QuickBooks Desktop Pro- Instructions

Tuesday, May 09 2023

How to Create an Invoice in QuickBooks Desktop Pro: Video This video lesson, titled “Learn How to Create an Invoice in Intuit QuickBooks Desktop Pro 2023: A Training Tutorial,” shows how to create an invoice in QuickBooks Desktop Pro. This video lesson is from our complete QuickBooks tutorial, titled “Mastering QuickBooks Desktop Pro Made

- Published in Latest, Quickbooks

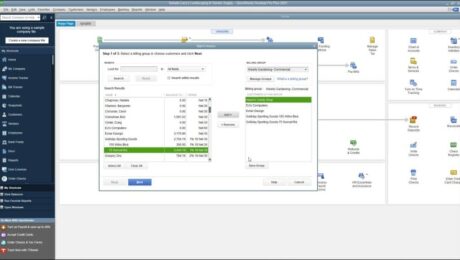

Batch Invoices in QuickBooks Desktop Pro- Instructions

Tuesday, May 02 2023

Create Batch Invoices in QuickBooks Desktop Pro: Video This video lesson, titled “Learn How to Create Batch Invoices in Intuit QuickBooks Desktop Pro 2023: A Training Tutorial,” shows you how to create batch invoices in QuickBooks Desktop Pro. This video is from our complete QuickBooks tutorial, titled “Mastering QuickBooks Desktop Pro Made Easy v.2023.”

- Published in Latest, Quickbooks