Small Business Accounting Tutorial Course

Course Description

If you are new to small business accounting or need a refresher, this course is for you. From terminology to reading reports, small business accounting can sometimes be confusing. During this 3 hour Accounting video training course, our expert instructor will teach you about different types of accounts (asset, liability, equity, income and expense), payroll, financial statements and much more.

This accounting training covers the same material as our classroom training and was designed to provide a solid foundation in accounting.

Course Syllabus & Sample Lessons

Select any of the video lessons markedto view them in a new window.

| CHAPTER 1- | Introduction and Overview | |

| Lesson 1.1- | What is Accounting? | |

| Lesson 1.2- | Accounting Methods | |

| Lesson 1.3- | Ethics in Financial Reporting | |

| Lesson 1.4- | Introduction to Financial Statements | |

| Lesson 1.5- | Business Activities | |

| Lesson 1.6- | GAAP | |

| Lesson 1.7- | Sarbanes-Oxley Act | |

| Lesson 1.8- | Accrual vs. Cash Basis of Accounting | |

| CHAPTER 2- | Financial Statements | |

| Lesson 2.1- | Balance Sheets | |

| Lesson 2.2- | Accounting Transactions | |

| Lesson 2.3- | Debits and Credits | |

| Lesson 2.4- | T-Accounts and Journal Entries | |

| Lesson 2.5- | The Balance Sheet | |

| Lesson 2.6- | Income Statements | |

| Lesson 2.7- | Retained Earnings Statement | |

| Lesson 2.8- | Statement of Cash Flows | |

| CHAPTER 3- | Assets | |

| Lesson 3.1- | Introduction to Assets | |

| Lesson 3.2- | Current Assets | |

| Lesson 3.3- | Property, Plant and Equipment | |

| Lesson 3.4- | Long-Term Investments | |

| Lesson 3.5- | Intangible Assets | |

| Lesson 3.6- | Depreciation | |

| CHAPTER 4- | Liabilities | |

| Lesson 4.1- | Introduction to Liabilities | |

| Lesson 4.2- | Current Liabilities | |

| Lesson 4.3- | Notes Payable | |

| Lesson 4.4- | Sales Tax Payable | |

| Lesson 4.5- | Unearned Revenue | |

| Lesson 4.6- | Payroll Payable | |

| Lesson 4.7- | Long-Term Liabilities | |

| CHAPTER 5- | Other Accounting Transactions | |

| Lesson 5.1- | The Trial Balance | |

| Lesson 5.2- | Adjusting Entries | |

| Lesson 5.3- | Closing the Books | |

| Lesson 5.4- | Sales Revenues, Gross Profits & Operating Activities | |

| CHAPTER 6- | Inventory | |

| Lesson 6.1- | Classifying Inventory | |

| Lesson 6.2- | Determining Inventory Quantities | |

| Lesson 6.3- | Cost of Goods Sold | |

| Lesson 6.4- | FIFO and LIFO | |

| Lesson 6.5- | Average Cost Method | |

| CHAPTER 7- | Stockholder’s Equity | |

| Lesson 7.1- | Corporate Form of Organization | |

| Lesson 7.2- | Stock Issue Considerations | |

| Lesson 7.3- | Accounting for Treasury Stock | |

| Lesson 7.4- | Preferred Stock | |

| Lesson 7.5- | Dividends and Retained Earnings | |

| CHAPTER 8- | Managerial Accounting | |

| Lesson 8.1- | Introduction to Managerial Accounting | |

| Lesson 8.2- | Code of Ethics for Managerial Accounting | |

| Lesson 8.3- | Managerial Cost Concepts | |

| Lesson 8.4- | Other Managerial Concepts | |

| CHAPTER 9- | Cost Accounting Systems | |

| Lesson 9.1- | Cost Accounting Systems | |

| Lesson 9.2- | Job Order Flow | |

| Lesson 9.3- | Reporting Job Order Costing | |

| Lesson 9.4- | Process Cost Systems | |

| Lesson 9.5- | Activity Based Costing | |

| CHAPTER 10- | Behavior of Costs and Expenses | |

| Lesson 10.1- | Cost Behavior | |

| Lesson 10.2- | Break-Even Analysis and Contribution Margin Ratio | |

| Lesson 10.3- | Margin of Safety | |

| CHAPTER 11- | Cost Controlling | |

| Lesson 11.1- | Budgetary Control | |

| Lesson 11.2- | Static and Flexible Budgets | |

| Lesson 11.3- | Responsibility Accounting | |

| Lesson 11.4- | Standard Costs | |

| Lesson 11.5- | Analyzing and Reporting Variances | |

| CHAPTER 12- | Profit and Budget Planning | |

| Lesson 12.1- | Budgeting Basics | |

| Lesson 12.2- | Preparing the Operating Budgets | |

| Lesson 12.3- | Preparing the Financial Budgets | |

| CHAPTER 13- | Management Decision Making | |

| Lesson 13.1- | Introduction to Management Decision Making | |

| Lesson 13.2- | Incremental Analysis | |

| Lesson 13.3- | Capital Budgeting and Annual Rate of Return | |

| Lesson 13.4- | Other Tools for Analysis and Decision Making |

Small Business Accounting Training Course Overview

This introduction to small business & managerial accounting is designed to get you up and running. Whether you are setting up your company in QuickBooks for the first time, interviewing for a job that requires basic accounting knowledge or you just want to increase your knowledge in accounting, this course is for you.

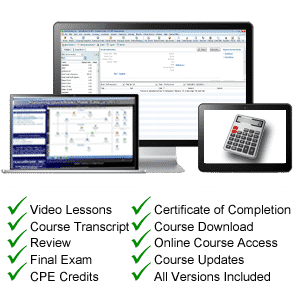

Course includes video lessons, printable course transcript, a practice exam with evaluative feedback (find out why your answers are right or wrong), your final exam submission, and a course certificate of completion.

At TeachUcomp, Inc., you choose how you want your accounting training delivered.

Online subscriptions offer the most flexibility and value. With online training, you can access your courses anytime and anywhere you have an internet connection (including all new releases and updates). Your subscription grants you instant access to ALL of our courses for one low price. There are no contracts and you can cancel at any time. You may choose between a monthly or annual plan.

Courses are also available individually via digital download and online for a one-time charge.