Create an Invoice in QuickBooks Online- Instructions

Create an Invoice in QuickBooks Online: Video

This video lesson, titled “Creating an Invoice,” shows how to create an invoice in QuickBooks Online. This video lesson is from our complete QuickBooks Online tutorial, titled “Mastering QuickBooks Online Made Easy.”

Overview of How to Create an Invoice in QuickBooks Online:

About Invoice Layouts in QuickBooks Online:

Invoices in QuickBooks Online use either a simplified “new layout” or an “old layout.” As of the time of this writing, Intuit is still rolling out the “new layout.” Also, if it is available, changing certain sales settings may require you to use the old layout, instead. If this is the case, you will see that warning appear when you change the related “Sales” settings. For example, enabling a “Deposit” field in invoices also forces the use of the “old layout.” However, many of the invoicing features remain the same between invoice layouts, although you customize them differently. To switch between layouts, if available, click either the “Old layout” or “Try the new invoices” button in the toolbar towards the upper-right corner of the invoice window.

How to Create an Invoice in QuickBooks Online:

To create a customer invoice, either click the “Create Invoice” link under the “Action” column for the customer’s row in the “Customers” page or click the “+ New” button in the Navigation Bar and then click the “Invoice” link under the “Customers” heading in the drop-down menu that appears. In the “Invoice” window that then opens, enter the information needed to invoice the customer.

How to Select a Customer for an Invoice in QuickBooks Online:

To choose a customer, select one from the “Customer” drop-down in the upper-left corner of the window. If selecting an existing customer’s record, their information then populates other fields in the form, based on what you entered when you created the customer’s record. Alternatively, you can type a customer’s name or select the “Add new” choice from this drop-down to quickly add a new customer.

If using the “old layout,” then to the right of the “Customer” drop-down is a “Customer email” field. This field is populated with the customer’s email address, if you entered it when creating the customer’s record. You can enter an email here if you didn’t enter it when you created the customer or if adding a customer “on the fly.” To inspect the customer data if using the “new layout,” click the “Edit customer” link below the “Customer” drop-down to open the “Customer” pane at the right side of the window, where you can check and change this information, as needed, and then save it.

How to Change Customer and General Invoice Information in QuickBooks Online:

To email copies of this invoice to others if using the “old layout,” then click the “Cc/Bcc” link by the “Email” field to show additional “Cc” and “Bcc” fields in a drop-down menu. Then enter the email addresses into these fields, as needed, and click the “Done” button. To email copies if using the “new layout,” wait until you finish the invoice and then click the “Review and send” button in the lower-right corner. In the window that appears, then click the “Cc/Bcc” link by the “To” field to show the additional field where you can then enter these email addresses.

To mark the invoice as an invoice to save but email later if using the “old layout,” check the “Send later” checkbox below the “Email” field. Later you can email these invoices as a batch action from the “All Sales” page, if desired.

If you already enabled online payments for invoices in QuickBooks Online and are using the “old layout,” check the “Cards” and/or “Bank transfer” checkboxes under the “Online payments” label to the right, as needed, to enable the respective online payment method. If using the “new layout,” click the “Edit” link next to the “Customer payment options” label below the line item area, instead. Note you must first have online payments enabled through QuickBooks Online before you can use these. If interested in enabling online payment in QuickBooks Online, you can click the adjacent “Set up for Payments” link if using the “old layout” or the “Set up” link if using the “new layout” to set up payments through QuickBooks Online.

The “Billing address” or “Bill to” field is populated with the customer’s address. If using the “old layout,” you can enter or change their billing address for the invoice here. To the right, the customer’s default terms appear in the “Terms” drop-down, and you can change this, if needed. The “Invoice date” field shows the current date, by default. If needed, you can click this field to select another date from the calendar drop-down that appears. The “Due date” field is calculated based on the selected “Terms” you chose. However, you can also click into this field to select a date, if needed.

If you enabled shipping and use the “old layout,” then enter the shipping information into the “Shipping to,” “Ship via,” “Shipping date,” and “Tracking no.” fields that appear, as needed. The “Shipping to” field shows the customer’s default shipping address, if you entered that when you created the selected customer’s record. If using automatic sales tax calculations, the invoice’s sales taxes are calculated based on this address and, if empty, the “Location of sale” field’s value is used, instead. Alternatively, if using the “new layout,” the customer’s shipping information appears in the “Ship to” field. Like the “Bill to” field, it is not directly editable in the “new layout.” To edit customer information using the “new layout,” you must click the “Edit customer” link, change the data in the “Customer” pane that appears, and then save it.

If you enabled custom fields and are using the “old layout,” then enter any custom field data into those fields in the invoice, if needed. Note that custom fields don’t appear in the “new layout” for invoices and estimates, as of the date of this writing. At the right side of the window, the “Invoice no” field shows the next highest available invoice number. If you enabled custom transaction numbers in sales forms, then you can change this, if needed.

If you enabled location tracking and use the “old layout,” then a “Location” drop-down also appears at the top of the invoice form. Likewise, if you enabled class tracking on a transaction level and use the “old layout,” then a “Class” drop-down also appears here. Note that locations and classes are not yet available in the “new layout,” as of the date of this writing. If using the “old layout,” the “Location of sale” field shows your company’s default sales address. You can change this, if needed.

To add a tag to this transaction if using the “old layout,” click into the “Tags” field and select a tag from the menu of tags. Repeat, as needed, to apply tags from any tag groups you created. Alternatively, to add a new tag, type the tag’s name, select it from the “+ Add” choice in the drop-down menu, and follow the onscreen prompts to add it to a new tag group for reporting purposes. Note that this field doesn’t appear in the “new layout,” and you must instead apply tags within the “Tags” page to invoices and estimates that use that layout, as shown at the end of the earlier lesson titled “Creating and Using Tags.”

How to Enter Line Item Information for an Invoice in QuickBooks Online:

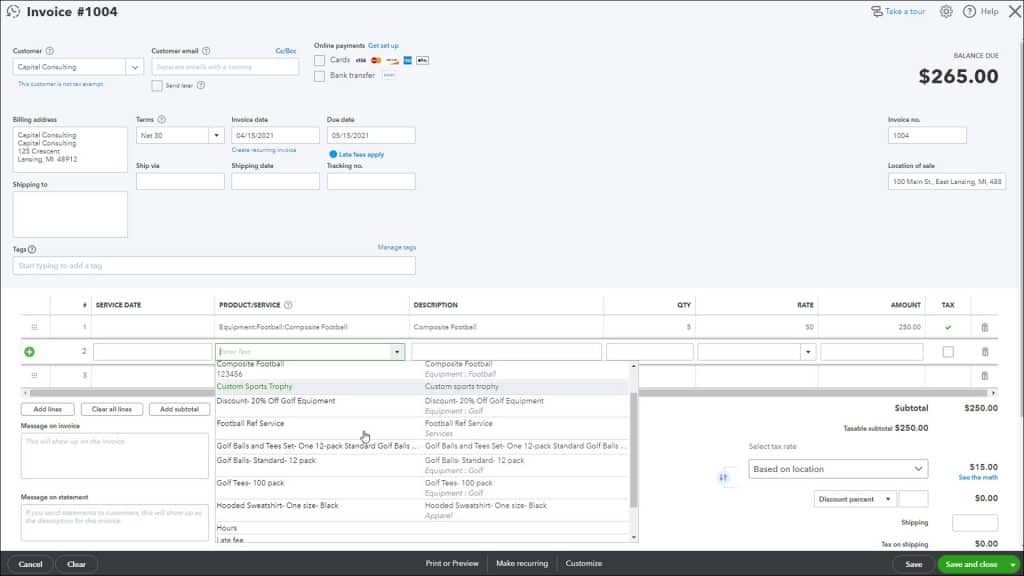

The next area is the line items area where you enter the products and/or services to invoice. If you enabled services dates in sales forms, you can select the service date of services provided from the “Service date” column or field. To select an existing item from the “Products and Services” list, click into the “Product/Service” column or field and then select the item from the drop-down menu. If SKUs are enabled, the item’s SKU appears in the “SKU” field. Its description appears in the “Description” field. You can also type a description here, if desired.

Enter the quantity of the product bought or service provided by typing it into the quantity field, labelled “Qty.” The rate for the product or service, per quantity unit, appears in the “Rate” field. You can change it, if needed. The “Qty” field is multiplied by the “Rate” field to show the total amount for the line item in the “Amount” field. If entering a product or service without a rate or quantity, you can simply enter the total amount into the “Amount” field, if needed. Also note that the “new layout” contains another drop-down that lets you select “Unit,” “Hour,” or “Flat rate.” If you select “Flat rate,” the “Unit/Hour” and “Qty” fields are removed for that line item, and you can then enter the flat amount into the “Amount” field.

If using the “old layout” and if the product or service is taxable, ensure the “Tax” field checkbox for the line item is checked. You can check or uncheck this, if needed, within this form. If using the “new layout,” you can only change the default sales tax status for a line item at the item level. To change the sales tax status of an item, if needed and if using the “new layout,” click the three-dot menu at the line item’s right end and then select the “Edit sales tax” command to open a pane that lets you change the default sales tax for the item and click the “Save” button to apply it.

If using the “old layout” and if classes are enabled and assigned by one to each row in transaction forms, then you can select a class from the “Class” drop-down. After entering the first line item, continue adding line items until you enter all the line items needed for the invoice.

At the left end of each line item row is a selection handle. To change the order of the line items, click and drag the line item up or down by this handle and then release it. To delete a line item, click the “Delete” button, which looks like a trash can icon, at the right end of the line item row to delete.

To add a new line-item row, click into the bottom line item row to automatically add a new row. If using the “new layout,” you can also click the “Add product or service” link to add a new blank line item. Alternatively, if using the “old layout,” to add 4 new rows at once, click the “Add lines” button under the line items area. To delete all line items, click the “Clear all lines” button in this same location. To add a subtotal line item to an “old layout” invoice, select the line item row above where you want to insert the subtotal row. Then click the “Add subtotal” button to add a subtotal line below the currently selected line. You can add as many subtotal lines as the invoice requires.

A picture showing how to create an invoice in QuickBooks Online when using the old layout for invoices.

How to Enter Customer Messages in Invoices in QuickBooks Online:

To enter a message to show on the invoice, type it into the “Message on invoice” field for the “old layout” or the “Note to customer” field in the “new layout.” If using the “old layout,” to enter a message that appears for this invoice in the customer’s statement, type it into the “Message on statement” field. To tell your customer how to pay you if using the “new layout,” type a payment message into the “Tell your customers how you want to get paid” field.

In the lower-left corner of the invoice is the “Attachments” field, which lets you attach a file to the invoice. You can drag and drop files onto the field or click the field to open a “File Upload” dialog box that you can use to browse for, and then select, the file to attach. Note the 20MB file attachment size limit.

How to Check and Change Totals, Sales Tax, and Discounts in Invoices in QuickBooks Online:

In the lower-right corner of the invoice is the subtotal, taxable subtotal, sales tax, discount, shipping and tax on shipping, total, deposit, and balance due field information, depending on which sales form features you enabled and which invoice layout you use. If using the “old layout,” then the “Select tax rate” drop-down lets you select either the default “Based on location” choice if using the automatic sales tax feature or select a custom sales tax rate, if you created those. Based on your selection, the sales tax to collect appears to the right.

If using the automatic sales tax and the “Based on location” choice, then you can click either the “See the math” link or “Edit tax” link under the sales tax amount to see the sales tax information and calculations and correct it, if needed, in the pane that then opens at the right side of the window. We’ll discuss this pane in detail in a later lesson in this chapter. For now, note that if you need to override the automatic sales tax calculation, you can click the “Override this amount” link in this pane’s lower-right corner to open a section at the bottom of the pane that lets you enter either a new “Rate” or “Amount” to charge for sales tax and then select a “Reason” from the drop-down. Then click the adjacent “Confirm” or “Apply override” button to confirm the override. Alternatively, to apply a custom sales tax rate if you created one and are using the “new layout,” select the custom sales tax rate from the “Sales tax rate” drop-down at the very top of this pane. After editing the sales tax, if needed, you can then close the pane by clicking the “Close” button in its lower-right corner.

Alternatively, to apply a custom sales tax rate if you created one and are using the “old layout,” select the custom sales tax rate from the “Select tax rate” drop-down. The amount of sales tax to collect then appears in a field to the right, which you can change, if needed.

To apply a discount to the invoice if you enabled a “Discount” field in your sales forms, either use the “Discount” drop-down that appears near the “Select tax rate” drop-down to select either the “Discount percent” or “Discount value” choice or click the “%” or “$” toggle switch if using the “new layout.” Then enter the percentage or amount into the adjacent field.

The discount is related to sales tax because you can change whether the discount is applied before or after calculating sales tax in QuickBooks Online, as needed. To change this if using the “old layout,” click the button that looks like “up” and “down” arrows in a blue circle to the left of the sales tax rate and discount fields to switch the order of the two fields in the invoice each time you click it. Doing this changes whether the discount is applied after sales tax is calculated or before sales tax is calculated, based on the order in which the fields appear in the invoice. Alternatively, if using the “new layout,” click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window. Then click the “Payment options” link. Then check or uncheck the “Apply discount after sales tax” checkbox, as needed.

If shipping is enabled and you use the “old layout,” then you can enter the amount of shipping into the “Shipping” field. The “Tax on shipping” field, if enabled, shows the sales tax on the shipping. If using the new layout, you may need to enable a “Shipping fee” field before you can enter shipping fees and see the sales tax, if needed. To enable the shipping fee field in the “new layout,” click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window. Then click the “Invoice settings” link. Then click the “Totals” section to expand it. Then toggle the “Shipping fee” toggle switch to the “On” position. You can then enter the shipping amount into the “Shipping” field in the invoice to add the shipping costs and, if applicable and if using the automatic sales tax calculations, the shipping sales tax to the invoice.

The “Total” or “Invoice total” field shows the invoice total amount. If enabled and if using the “old layout,” to record an amount paid as a deposit at the time of invoicing, enter the amount into the “Deposit” field. The “Balance due” field below that shows the remaining balance due, less the deposit.

How to Manage and Customize Invoices in QuickBooks Online:

The toolbar at the bottom of the invoice lists the actions you can perform on an invoice. Different options appear here when creating a new invoice versus opening an existing invoice. When creating a new invoice using the “old layout,” you will see “Cancel” and “Clear” buttons at the left side of the toolbar. Clicking “Cancel” cancels the invoice creation. Clicking “Clear” clears all the fields but keeps the window open. To cancel an invoice if using the “new layout,” click the “X” button in the upper-right corner and then click “Yes” in the prompt to close without saving.

In the middle of the toolbar when using the “old layout” are the “Print or Preview,” “Make recurring” and “Customize” buttons. Clicking the “Print or Preview” button shows a pop-up menu that lets you check a “Print later” checkbox or click either the “Print or preview” or “Print packing slip” commands. Checking the “Print later” checkbox lets you filter by that delivery method if you batch print invoices later. Clicking the “Print or preview” command saves the invoice and opens a window that shows the invoice as a PDF and lets you preview or print it. Clicking the “Print packing slip” command saves the invoice and creates a packing slip from the invoice and shows it as a PDF so you can print it.

Clicking the “Make recurring” button in the “old layout” opens the “Recurring Invoice” window. Also note you can create recurring invoices if using the “new layout” by clicking the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window. Then click the “Automation” link. Then click the “Recurring invoice” link to open the same “Recurring Invoice” window in the “old layout” style. This window lets you create a recurring invoice, which is discussed in a separate lesson. You can click the “Cancel” button in the toolbar to cancel the recurring invoice and close the window.

Clicking the “Customize” command in the toolbar if using the “old layout” lets you select a different invoice template to use, edit the current invoice template, or create a new invoice template by selecting a command in the pop-up menu that appears.

The “new layout” doesn’t use templates, but you can customize its appearance by clicking the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window. Then click the “Design” section to expand it. Then select a color and font to use. Creating form templates if using the “old layout” is discussed in a separate lesson.

Alternatively, if using the “new layout,” the middle of the toolbar contains an “Other actions” link you can click to select either the “Make a copy” command, which makes a copy of the invoice, or the “Receive payment” command, which lets you receive payment on the invoice. We’ll discuss receiving payment on an invoice in a later lesson.

How to Save and Send Invoices in QuickBooks Online:

To save the invoice after creating it, click the “Save” button towards the right end of the toolbar. To save and send the invoice by email, click the “Save and send” or “Review and send” button at the right end of the toolbar Alternatively, to save the invoice and then close the invoice or create another new invoice, click the drop-down on either the “Save” button if using the “new layout” or the “Save and send” button if using the “old layout,” and then click either the “Save and close” or “Save and new” command.

To save the invoice and send a link to the online invoice by email to the customer’s email address, click the drop-down on the green button at the right end of the toolbar and then select either the “Save and share link” command if using the “old layout” or the “Share link” command if using the “new layout.” The link also appears in a window onscreen, so you can then copy the link to send to them via other channels, if desired. You can then close the link window.

Note that clicking the drop-down on the green button at the right end of the toolbar if using the “new layout” also shows options for “Receive payment” and “Print and download.” Selecting the “Receive payment” command opens the “Receive payment” window, which we’ll discuss in a later lesson. Selecting the “Print and download” link opens the invoice as a PDF in a new browser tab or window so you can then use the buttons in the toolbar at the top of the PDF preview to print or download it as a PDF to manually send to the customer, if needed. You can then close the window.

How to Open and Manage Saved Invoices in QuickBooks Online:

To open an invoice for editing after saving it, click it within the “Invoices” page to show information about it in a pane at the right side of the window. Then click the “Edit invoice” button at the bottom of the pane to reopen it or click the “More actions” button to select from a full list of editing actions, like “Delete” “Print packing slip,” or “Void,” among others.

However, if you reopen the invoice for editing and are using the “old layout,” then a new “More” button also appears in the toolbar at the bottom of the invoice. Clicking this button shows other action commands for “Copy,” to copy the invoice; “Void,” to void the invoice; “Delete,” to delete the invoice; “Transaction journal,” to open a report that lists the accounts and credit and debit amounts for the invoice; and “Audit history,” which shows an audit history of the invoice. You can click any of these actions to perform the related activity.

Likewise, clicking the “Other actions” button in the center of the toolbar if using the “new layout” and editing a saved invoice shows the new “Delete” and “Void” commands in addition to the other commands that previously appeared in the menu. You can select these commands to delete or void the invoice from within the invoice form, if needed.

Instructions on How to Create an Invoice in QuickBooks Online:

- Invoices in QuickBooks Online use either a simplified “new layout” or an “old layout.” As of the time of this writing, Intuit is still rolling out the “new layout.” Also, if it is available, changing certain sales settings may require you to use the old layout, instead.

- To switch between layouts, if available, click either the “Old layout” or “Try the new invoices” button in the toolbar towards the upper-right corner of the invoice window.

- To create a customer invoice, either click the “Create Invoice” link under the “Action” column for the customer’s row in the “Customers” page or click the “+ New” button in the Navigation Bar and then click the “Invoice” link under the “Customers” heading in the drop-down menu that appears.

- In the “Invoice” window that then opens, enter the information needed to invoice the customer.

- To choose a customer, select one from the “Customer” drop-down in the upper-left corner of the window.

- If selecting an existing customer’s record, their information then populates other fields in the form, based on what you entered when you created the customer’s record.

- Alternatively, you can type a customer’s name or select the “Add new” choice from this drop-down to quickly add a new customer.

- If using the “old layout,” then to the right of the “Customer” drop-down is a “Customer email” field. This field is populated with the customer’s email address, if you entered it when creating the customer’s record. You can enter an email here if you didn’t enter it when you created the customer or if adding a customer “on the fly.”

- To inspect the customer data if using the “new layout,” click the “Edit customer” link below the “Customer” drop-down to open the “Customer” pane at the right side of the window, where you can check and change this information, as needed, and then save it.

- To email copies of this invoice to others if using the “old layout,” then click the “Cc/Bcc” link by the “Email” field to show additional “Cc” and “Bcc” fields in a drop-down menu.

- Then enter the email addresses into these fields, as needed, and click the “Done” button.

- To email copies if using the “new layout,” wait until you finish the invoice and then click the “Review and send” button in the lower-right corner.

- In the window that appears, then click the “Cc/Bcc” link by the “To” field to show the additional field where you can then enter these email addresses.

- To mark the invoice as an invoice to save but email later if using the “old layout,” check the “Send later” checkbox below the “Email” field. Later you can email these invoices as a batch action from the “All Sales” page, if desired.

- If you already enabled online payments for invoices in QuickBooks Online and are using the “old layout,” check the “Cards” and/or “Bank transfer” checkboxes under the “Online payments” label to the right, as needed, to enable the respective online payment method.

- If using the “new layout,” click the “Edit” link next to the “Customer payment options” label below the line item area, instead. Note that you must first have online payments enabled through QuickBooks Online before you can use these.

- If interested in enabling online payment in QuickBooks Online, you can click the adjacent “Set up for Payments” link if using the “old layout” or the “Set up” link if using the “new layout” to set up payments through QuickBooks Online.

- The “Billing address” or “Bill to” field is populated with the customer’s address.

- If using the “old layout,” you can enter or change their billing address for the invoice here.

- To the right, the customer’s default terms appear in the “Terms” drop-down, and you can change this, if needed.

- The “Invoice date” field shows the current date, by default.

- If needed, you can click this field to select another date from the calendar drop-down that appears.

- The “Due date” field is calculated based on the selected “Terms” you chose. However, you can also click into this field to select a date, if needed.

- If you enabled shipping and use the “old layout,” then enter the shipping information into the “Shipping to,” “Ship via,” “Shipping date,” and “Tracking no.” fields that appear, as needed.

- The “Shipping to” field shows the customer’s default shipping address if you entered that when you created the selected customer’s record.

- If using automatic sales tax calculations, the invoice’s sales taxes are calculated based on this address and, if empty, the “Location of sale” field’s value is used, instead.

- Alternatively, if using the “new layout,” the customer’s shipping information appears in the “Ship to” field. Like the “Bill to” field, it is not directly editable in the “new layout.”

- To edit customer information using the “new layout,” you must click the “Edit customer” link, change the data in the “Customer” pane that appears, and then save it.

- If you enabled custom fields and are using the “old layout,” then enter any custom field data into those fields in the invoice, if needed. Note that custom fields don’t appear in the “new layout” for invoices and estimates, as of the date of this writing.

- At the right side of the window, the “Invoice no” field shows the next highest available invoice number.

- If you enabled custom transaction numbers in sales forms, then you can change this, if needed.

- If you enabled location tracking and use the “old layout,” then a “Location” drop-down also appears at the top of the invoice form.

- Likewise, if you enabled class tracking on a transaction level and use the “old layout,” then a “Class” drop-down also appears here. Note that locations and classes are not yet available in the “new layout,” as of the date of this writing.

- If using the “old layout,” the “Location of sale” field shows your company’s default sales address. You can change this, if needed.

- To add a tag to this transaction if using the “old layout,” click into the “Tags” field and select a tag from the menu of tags.

- Repeat, as needed, to apply tags from any tag groups you created.

- Alternatively, to add a new tag, type the tag’s name, select it from the “+ Add” choice in the drop-down menu, and follow the onscreen prompts to add it to a new tag group for reporting purposes.

- Note that this field doesn’t appear in the “new layout,” and you must instead apply tags within the “Tags” page to invoices and estimates that use that layout, as shown at the end of the earlier lesson titled “Creating and Using Tags.”

- The next area is the line items area where you enter the products and/or services to invoice.

- If you enabled services dates in sales forms, you can select the service date of services provided from the “Service date” column or field.

- To select an existing item from the “Products and Services” list, click into the “Product/Service” column or field and then select the item from the drop-down menu.

- If SKUs are enabled, the item’s SKU appears in the “SKU” field.

- Its description appears in the “Description” field. You can also type a description here, if desired.

- Enter the quantity of the product bought or service provided by typing it into the quantity field, labelled “Qty.”

- The rate for the product or service, per quantity unit, appears in the “Rate” field. You can change it, if needed.

- The “Qty” field is multiplied by the “Rate” field to show the total amount for the line item in the “Amount” field.

- If entering a product or service without a rate or quantity, you can simply enter the total amount into the “Amount” field, if needed.

- Also note that the “new layout” contains another drop-down that lets you select “Unit,” “Hour,” or “Flat rate.”

- If you select “Flat rate,” the “Unit/Hour” and “Qty” fields are removed for that line item, and you can then enter the flat amount into the “Amount” field.

- If using the “old layout” and if the product or service is taxable, ensure the “Tax” field checkbox for the line item is checked. You can check or uncheck this, if needed, within this form.

- If using the “new layout,” you can only change the default sales tax status for a line item at the item level.

- To change the sales tax status of an item, if needed and if using the “new layout,” click the three-dot menu at the line item’s right end and then select the “Edit sales tax” command to open a pane that lets you change the default sales tax for the item and click the “Save” button to apply it.

- If using the “old layout” and if classes are enabled and assigned by one to each row in transaction forms, then you can select a class from the “Class” drop-down.

- After entering the first line item, continue adding line items until you enter all the line items needed for the invoice.

- At the left end of each line item row is a selection handle.

- To change the order of the line items, click and drag the line item up or down by this handle and then release it.

- To delete a line item, click the “Delete” button, which looks like a trash can icon, at the right end of the line item row to delete.

- To add a new line-item row, click into the bottom line item row to automatically add a new row.

- If using the “new layout,” you can also click the “Add product or service” link to add a new blank line item.

- Alternatively, if using the “old layout,” to add 4 new rows at once, click the “Add lines” button under the line items area.

- To delete all line items, click the “Clear all lines” button in this same location.

- To add a subtotal line item to an “old layout” invoice, select the line item row above where you want to insert the subtotal row.

- Then click the “Add subtotal” button to add a subtotal line below the currently selected line. You can add as many subtotal lines as the invoice requires.

- To enter a message to show on the invoice, type it into the “Message on invoice” field for the “old layout” or the “Note to customer” field in the “new layout.”

- If using the “old layout,” to enter a message that appears for this invoice in the customer’s statement, type it into the “Message on statement” field.

- To tell your customer how to pay you if using the “new layout,” type a payment message into the “Tell your customers how you want to get paid” field.

- In the lower-left corner of the invoice is the “Attachments” field, which lets you attach a file to the invoice.

- You can drag and drop files onto the field or click the field to open a “File Upload” dialog box that you can use to browse for, and then select, the file to attach. Note the 20MB file attachment size limit.

- In the lower-right corner of the invoice is the subtotal, taxable subtotal, sales tax, discount, shipping and tax on shipping, total, deposit, and balance due field information, depending on which sales form features you enabled and which invoice layout you use.

- If using the “old layout,” then the “Select tax rate” drop-down lets you select either the default “Based on location” choice if using the automatic sales tax feature or select a custom sales tax rate, if you created those.

- Based on your selection, the sales tax to collect appears to the right.

- If using the automatic sales tax and the “Based on location” choice, then you can click either the “See the math” link or “Edit tax” link under the sales tax amount to see the sales tax information and calculations and correct it, if needed, in the pane that then opens at the right side of the window. We’ll discuss this pane in detail in a later lesson in this chapter.

- For now, note that if you need to override the automatic sales tax calculation, you can click the “Override this amount” link in this pane’s lower-right corner to open a section at the bottom of the pane that lets you enter either a new “Rate” or “Amount” to charge for sales tax and then select a “Reason” from the drop-down.

- Then click the adjacent “Confirm” or “Apply override” button to confirm the override.

- Alternatively, to apply a custom sales tax rate if you created one and are using the “new layout,” select the custom sales tax rate from the “Sales tax rate” drop-down at the very top of this pane.

- After editing the sales tax, if needed, you can then close the pane by clicking the “Close” button in its lower-right corner.

- Alternatively, to apply a custom sales tax rate if you created one and are using the “old layout,” select the custom sales tax rate from the “Select tax rate” drop-down.

- The amount of sales tax to collect then appears in a field to the right, which you can change, if needed.

- To apply a discount to the invoice if you enabled a “Discount” field in your sales forms, either use the “Discount” drop-down that appears near the “Select tax rate” drop-down to select either the “Discount percent” or “Discount value” choice or click the “%” or “$” toggle switch if using the “new layout.”

- Then enter the percentage or amount into the adjacent field.

- The discount is related to sales tax because you can change whether the discount is applied before or after calculating sales tax in QuickBooks Online, as needed.

- To change this if using the “old layout,” click the button that looks like “up” and “down” arrows in a blue circle to the left of the sales tax rate and discount fields to switch the order of the two fields in the invoice each time you click it. Doing this changes whether the discount is applied after sales tax is calculated or before sales tax is calculated, based on the order in which the fields appear in the invoice.

- Alternatively, if using the “new layout,” click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window.

- Then click the “Payment options” link.

- Then check or uncheck the “Apply discount after sales tax” checkbox, as needed.

- If shipping is enabled and you use the “old layout,” then you can enter the amount of shipping into the “Shipping” field.

- The “Tax on shipping” field, if enabled, shows the sales tax on the shipping.

- If using the “new layout,” you may need to enable a “Shipping fee” field before you can enter shipping fees and see the sales tax, if needed.

- To enable the shipping fee field in the “new layout,” click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window.

- Then click the “Payment options” link.

- Then toggle the “Shipping fee” toggle switch to the “On” position.

- You can then enter the shipping amount into the “Shipping” field in the invoice to add the shipping costs and, if applicable and if using the automatic sales tax calculations, the shipping sales tax to the invoice.

- The “Total” or “Invoice total” field shows the invoice total amount.

- If enabled and if using the “old layout,” to record an amount paid as a deposit at the time of invoicing, enter the amount into the “Deposit” field.

- The “Balance due” field below that shows the remaining balance due, less the deposit.

- The toolbar at the bottom of the invoice lists the actions you can perform on an invoice. Different options appear here when creating a new invoice versus opening an existing invoice.

- When creating a new invoice using the “old layout,” you will see “Cancel” and “Clear” buttons at the left side of the toolbar.

- Clicking “Cancel” cancels the invoice creation.

- Clicking “Clear” clears all the fields but keeps the window open.

- To cancel an invoice if using the “new layout,” click the “X” button in the upper-right corner and then click “Yes” in the prompt to close without saving.

- In the middle of the toolbar when using the “old layout” are the “Print or Preview,” “Make recurring” and “Customize” buttons.

- Clicking the “Print or Preview” button shows a pop-up menu that lets you check a “Print later” checkbox or click either the “Print or preview” or “Print packing slip” commands.

- Checking the “Print later” checkbox lets you filter by that delivery method if you batch print invoices later.

- Clicking the “Print or preview” command saves the invoice and opens a window that shows the invoice as a PDF and lets you preview or print it.

- Clicking the “Print packing slip” command saves the invoice and creates a packing slip from the invoice and shows it as a PDF so you can print it.

- Clicking the “Make recurring” button in the “old layout” opens the “Recurring Invoice” window.

- To create recurring invoices if using the “new layout,” click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window.

- Then click the “Automation” link.

- Then click the “Recurring invoice” link to open the same “Recurring Invoice” window in the “old layout” style.

- This window lets you create a recurring invoice, which is discussed in a separate lesson.

- You can click the “Cancel” button in the toolbar to cancel the recurring invoice and close the window.

- Clicking the “Customize” command in the toolbar if using the “old layout” lets you select a different invoice template to use, edit the current invoice template, or create a new invoice template by selecting a command in the pop-up menu that appears.

- The “new layout” doesn’t use templates, but to customize its appearance, click the “Manage” button in the toolbar at the top of the window, if needed, to show a pane at the right side of the window.

- Then click the “Design” section to expand it.

- Then select a color and font to use.

- Creating form templates if using the “old layout” is discussed in a separate lesson.

- Alternatively, if using the “new layout,” the middle of the toolbar contains an “Other actions” link you can click to select either the “Make a copy” command, which makes a copy of the invoice, or the “Receive payment” command, which lets you receive payment on the invoice. We’ll discuss receiving payment on an invoice in a later lesson.

- To save the invoice after creating it, click the “Save” button towards the right end of the toolbar.

- To save and send the invoice by email, click the “Save and send” or “Review and send” button at the right end of the toolbar

- Alternatively, to save the invoice and then close the invoice or create another new invoice, click the drop-down on either the “Save” button if using the “new layout” or the “Save and send” button if using the “old layout,” and then click either the “Save and close” or “Save and new” command.

- To save the invoice and send a link to the online invoice by email to the customer’s email address, click the drop-down on the green button at the right end of the toolbar and then select either the “Save and share link” command if using the “old layout” or the “Share link” command if using the “new layout.”

- The link also appears in a window onscreen, so you can then copy the link to send to them via other channels, if desired.

- You can then close the link window.

- Note that clicking the drop-down on the green button at the right end of the toolbar if using the “new layout” also shows options for “Receive payment” and “Print and download.”

- Selecting the “Receive payment” command opens the “Receive payment” window, which we’ll discuss in a later lesson.

- Selecting the “Print and download” link opens the invoice as a PDF in a new browser tab or window so you can then use the buttons in the toolbar at the top of the PDF preview to print or download it as a PDF to manually send to the customer, if needed.

- You can then close the window.

- To open an invoice for editing after saving it, click it within the “Invoices” page to show information about it in a pane at the right side of the window.

- Then click the “Edit invoice” button at the bottom of the pane to reopen it or click the “More actions” button to select from a full list of editing actions, like “Delete” “Print packing slip,” or “Void,” among others.

- However, if you reopen the invoice for editing and are using the “old layout,” then a new “More” button also appears in the toolbar at the bottom of the invoice.

- Clicking this button shows other action commands for “Copy,” to copy the invoice; “Void,” to void the invoice; “Delete,” to delete the invoice; “Transaction journal,” to open a report that lists the accounts and credit and debit amounts for the invoice; and “Audit history,” which shows an audit history of the invoice.

- You can click any of these actions to perform the related activity.

- Likewise, clicking the “Other actions” button in the center of the toolbar if using the “new layout” and editing a saved invoice shows the new “Delete” and “Void” commands in addition to the other commands that previously appeared in the menu.

- You can select these commands to delete or void the invoice from within the invoice form, if needed.