Introduction to Financial Statements- Tutorial

Tuesday, April 07 2015

Introduction to Financial Statements: Video Lesson This video lesson, titled “Introduction to Financial Statements,” gives a brief overview and introduction to financial statements. This video is from our complete accounting tutorial, titled “Mastering Accounting Made Easy v.2.0.” Introduction to Financial Statements: Overview This tutorial gives you an introduction to financial statements commonly used

- Published in Business, Latest, Small Business Accounting

No Comments

The Cash Manager in Peachtree Accounting

Tuesday, May 27 2014

The Cash Manager in Peachtree Accounting: Video This video shows you how to use the Cash Manager in Peachtree Accounting. Need more Peachtree training? Click here for the complete tutorial. The Cash Manager in Peachtree Accounting: Overview The Cash Manager in Peachtree Accounting is available only in Peachtree Accounting or higher. It has been reformatted in

Setting Up a Job in Peachtree Accounting

Thursday, May 22 2014

Setting Up a Job in Peachtree Accounting: Video This video lesson shows setting up a job in Peachtree Accounting. Need more training? Click here for the complete tutorial. Setting Up a Job in Peachtree Accounting: Overview In Peachtree, you can set up “Jobs” for each client. You can then track income and expenses for specific

QuickBooks 2014 Training: How to Use QuickBooks Payroll- Creating Paychecks (pt 4)

Friday, May 09 2014

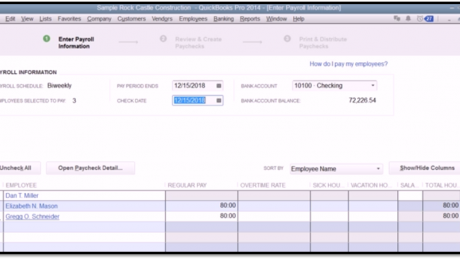

Click here for the complete QuickBooks tutorial. This post is part 4 of a QuickBooks Payroll training series. Click here for parts: 1 2 and 3 Creating Unscheduled Paychecks You can also create unscheduled paychecks for additional checks, such as bonus checks. You can select “Employees| Pay Employees| Unscheduled Payroll” from the Menu

- Published in Latest, Quickbooks

QuickBooks 2014 Training: How to Use QuickBooks Payroll- Creating Payroll Schedules (pt 3)

Thursday, May 08 2014

Click here for the complete QuickBooks tutorial. This post is part 3 of a QuickBooks Payroll training series. Click here for parts: 1 and 2 Creating Payroll Schedules In QuickBooks, you will most often create employee paychecks by using the scheduled payroll feature. However, if needed, you can also

- Published in Latest, Quickbooks

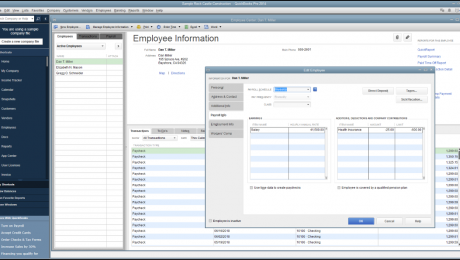

QuickBooks 2014 Training: How to Use QuickBooks Payroll- Setting Up Employee Payroll(pt 2)

Monday, May 05 2014

For the complete QuickBooks 2014 training, click here Setting Up Employee Payroll Information You can enter employee payroll information when you add new employees to the “Employees” list within the “New Employee” window. You can also edit the employee’s payroll data by using the “Edit Employee” window,

- Published in Latest, Quickbooks

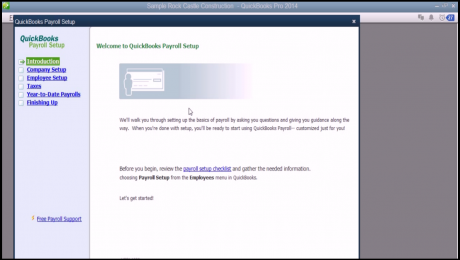

QuickBooks 2014 Training: How to Use QuickBooks Payroll- The Payroll Process (pt 1)

Friday, May 02 2014

To view the complete tutorial, click here The QuickBooks Payroll Process: Before you can use the payroll features of QuickBooks, you must set up payroll for your company in QuickBooks. To find out how you do this, select “Employees| Payroll| Turn on Payroll in QuickBooks” from the

- Published in Latest, Quickbooks

Tax Filing Tips for Tax Year 2013

Wednesday, January 22 2014

There are a few changes for 2013 that tax tax payers should be aware of. Some of the changes include changes in credits while some refer to when and how to file. In this post we will try to give tax payers a few tips to make filing in 2014 a smoother and less

- Published in News