QuickBooks Online Tutorial Course

Course Description

Learn QuickBooks Online with this comprehensive course from TeachUcomp, Inc. Mastering QuickBooks Online Made Easy features 179 video lessons with over 11.5 hours of introductory through advanced instruction. Watch, listen and learn as your expert instructor guides you through each lesson step-by-step. During this media-rich learning experience, you will see each function performed just as if your instructor were there with you. Reinforce your learning with the text of our printable classroom instruction manual (415 pages), additional images and practice exercises. You will learn how to set up a QuickBooks Online company file, pay employees and vendors, create custom reports, reconcile your accounts, use estimating, time tracking and much more.

Whether you are completely new to QuickBooks Online or migrating from a different version, this course will empower you with the knowledge and skills necessary to be a proficient user. We have incorporated years of classroom training experience and teaching techniques to develop an easy-to-use course that you can customize to meet your personal learning needs. Simply launch the easy-to-use interface, click to start a video lesson or open the manual and you’re on your way to mastering QuickBooks Online.

Course Syllabus & Sample Lessons

Select any of the video lessons markedto view them in a new window.

To view a sample of the instruction manual in PDF, click here: QuickBooks Online Manual

| CHAPTER 1- | The QuickBooks Online Plus Environment | |

| Lesson 1.1- | The QuickBooks Online Interface | |

| Lesson 1.2- | The Dashboard Page | |

| Lesson 1.3- | The Navigation Bar | |

| Lesson 1.4- | The + New Button | |

| Lesson 1.5- | The Settings Button | |

| Lesson 1.6- | Accountant View and Business View | |

| CHAPTER 2- | Creating a Company File | |

| Lesson 2.1- | Signing Up for QuickBooks Online Plus | |

| Lesson 2.2- | Importing Company Data | |

| Lesson 2.3- | Creating a New Company File | |

| Lesson 2.4- | How Backups Work in QuickBooks Online Plus | |

| Lesson 2.5- | Setting Up and Managing Users | |

| Lesson 2.6- | Transferring the Primary Admin | |

| Lesson 2.7- | Customizing Company File Settings | |

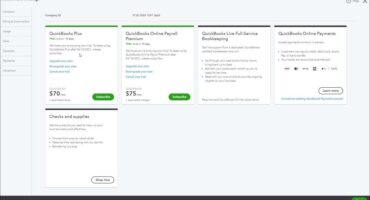

| Lesson 2.8- | Customizing Billing and Subscription Settings | |

| Lesson 2.9- | Usage Settings | |

| Lesson 2.10- | Customizing Sales Settings | |

| Lesson 2.11- | Customizing Expenses Settings | |

| Lesson 2.12- | Customizing Payment Settings | |

| Lesson 2.13- | Customizing Time Settings | |

| Lesson 2.14- | Customizing Advanced Settings | |

| Lesson 2.15- | Signing Out of QuickBooks Online Plus | |

| Lesson 2.16- | Switching Company Files | |

| Lesson 2.17- | Cancelling a Company File | |

| CHAPTER 3- | Using Pages and Lists | |

| Lesson 3.1- | Using Lists and Pages | |

| Lesson 3.2- | The Chart of Accounts | |

| Lesson 3.3- | Adding New Accounts | |

| Lesson 3.4- | Assigning Account Numbers | |

| Lesson 3.5- | Adding New Customers | |

| Lesson 3.6- | The Customers Page and List | |

| Lesson 3.7- | Adding Employees to the Employees List | |

| Lesson 3.8- | Adding New Vendors | |

| Lesson 3.9- | The Vendors Page and List | |

| Lesson 3.10- | Sorting Lists | |

| Lesson 3.11- | Inactivating and Reactivating List Items | |

| Lesson 3.12- | Printing Lists | |

| Lesson 3.13- | Renaming and Merging List Items | |

| Lesson 3.14- | Creating and Using Tags | |

| Lesson 3.15- | Creating and Applying Customer Types | |

| CHAPTER 4- | Setting Up Sales Tax | |

| Lesson 4.1- | Enabling Sales Tax | |

| Lesson 4.2- | Adding, Editing, and Inactivating Sales Tax Agencies | |

| Lesson 4.3- | Adding, Editing, and Inactivating Custom Sales Tax Rates | |

| Lesson 4.4- | Indicating Taxable & Non-taxable Customers and Items | |

| CHAPTER 5- | Setting Up Inventory Items | |

| Lesson 5.1- | Setting Up Inventory | |

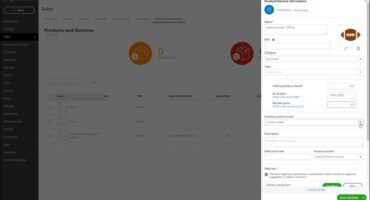

| Lesson 5.2- | Creating Inventory Items | |

| Lesson 5.3- | Enabling Purchase Orders and Custom Fields | |

| Lesson 5.4- | Creating a Purchase Order | |

| Lesson 5.5- | Applying Purchase Orders to Vendor Transactions | |

| Lesson 5.6- | Adjusting Inventory | |

| CHAPTER 6- | Setting Up Other Items | |

| Lesson 6.1- | Creating a Non-inventory or Service Item | |

| Lesson 6.2- | Creating a Bundle | |

| Lesson 6.3- | Creating a Discount Line Item | |

| Lesson 6.4- | Creating a Payment Line Item | |

| Lesson 6.5- | Changing Item Prices and Using Price Rules | |

| CHAPTER 7- | Basic Sales | |

| Lesson 7.1- | Enabling Custom Fields in Sales Forms | |

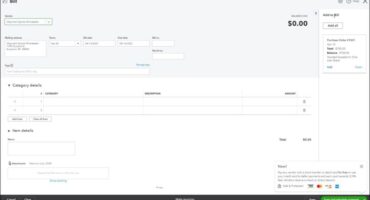

| Lesson 7.2- | Creating an Invoice | |

| Lesson 7.3- | Creating a Recurring Invoice | |

| Lesson 7.4- | Creating Batch Invoices | |

| Lesson 7.5- | Creating a Sales Receipt | |

| Lesson 7.6- | Finding Transaction Forms | |

| Lesson 7.7- | Previewing Sales Forms | |

| Lesson 7.8- | Printing Sales Forms | |

| Lesson 7.9- | Grouping and Subtotaling Items in Invoices | |

| Lesson 7.10- | Entering a Delayed Charge | |

| Lesson 7.11- | Managing Sales Transactions | |

| Lesson 7.12- | Checking and Changing Sales Tax in Sales Forms | |

| CHAPTER 8- | Creating Billing Statements | |

| Lesson 8.1- | About Statements and Customer Charges | |

| Lesson 8.2- | Automatic Late Fees | |

| Lesson 8.3- | Creating Customer Statements | |

| CHAPTER 9- | Payment Processing | |

| Lesson 9.1- | Recording Customer Payments | |

| Lesson 9.2- | Entering Overpayments | |

| Lesson 9.3- | Entering Down Payments or Prepayments | |

| Lesson 9.4- | Applying Customer Credits | |

| Lesson 9.5- | Making Deposits | |

| Lesson 9.6- | Handling Bounced Checks by Invoice | |

| Lesson 9.7- | Handling Bounced Checks by Expense or Journal Entry | |

| Lesson 9.8- | Handling Bad Debt | |

| CHAPTER 10- | Handling Refunds | |

| Lesson 10.1- | Refund Options in QuickBooks Online | |

| Lesson 10.2- | Creating a Credit Memo | |

| Lesson 10.3- | Creating a Refund Receipt | |

| Lesson 10.4- | Refunding Customer Payments by Check | |

| Lesson 10.5- | Creating a Delayed Credit | |

| CHAPTER 11- | Entering and Paying Bills | |

| Lesson 11.1- | Entering Bills | |

| Lesson 11.2- | Paying Bills | |

| Lesson 11.3- | Creating Terms for Early Bill Payment | |

| Lesson 11.4- | Early Bill Payment Discounts | |

| Lesson 11.5- | Entering a Vendor Credit | |

| Lesson 11.6- | Applying a Vendor Credit | |

| Lesson 11.7- | Managing Expense Transactions | |

| CHAPTER 12- | Using Bank Accounts | |

| Lesson 12.1- | Using Registers | |

| Lesson 12.2- | Writing Checks | |

| Lesson 12.3- | Printing Checks | |

| Lesson 12.4- | Transferring Funds Between Accounts | |

| Lesson 12.5- | Reconciling Accounts | |

| Lesson 12.6- | Voiding Checks | |

| Lesson 12.7- | Creating an Expense | |

| Lesson 12.8- | Managing Bank and Credit Card Transactions | |

| Lesson 12.9- | Creating and Managing Rules | |

| Lesson 12.10- | Uploading Receipts and Bills | |

| CHAPTER 13- | Paying Sales Tax | |

| Lesson 13.1- | Sales Tax Reports | |

| Lesson 13.2- | Using the Sales Tax Payable Register | |

| Lesson 13.3- | Paying Your Tax Agencies | |

| CHAPTER 14- | Reporting | |

| Lesson 14.1- | Creating Customer and Vendor QuickReports | |

| Lesson 14.2- | Creating Account QuickReports | |

| Lesson 14.3- | Using QuickZoom | |

| Lesson 14.4- | Standard Reports | |

| Lesson 14.5- | Basic Standard Report Customization | |

| Lesson 14.6- | Customizing General Report Settings | |

| Lesson 14.7- | Customizing Rows and Columns Report Settings | |

| Lesson 14.8- | Customizing Aging Report Settings | |

| Lesson 14.9- | Customizing Filter Report Settings | |

| Lesson 14.10- | Customizing Header and Footer Report Settings | |

| Lesson 14.11- | Resizing Report Columns | |

| Lesson 14.12- | Emailing, Printing, and Exporting Preset Reports | |

| Lesson 14.13- | Saving Customized Reports | |

| Lesson 14.14- | Using Report Groups | |

| Lesson 14.15- | Management Reports | |

| Lesson 14.16- | Customizing Management Reports | |

| CHAPTER 15- | Using Graphs | |

| Lesson 15.1- | Business Snapshot | |

| CHAPTER 16- | Customizing Forms | |

| Lesson 16.1- | Creating Custom Form Styles | |

| Lesson 16.2- | Custom Form Design Settings | |

| Lesson 16.3- | Custom Form Content Settings | |

| Lesson 16.4- | Custom Form Emails Settings | |

| Lesson 16.5- | Custom Form Styles | |

| CHAPTER 17- | Projects and Estimating | |

| Lesson 17.1- | Creating Projects | |

| Lesson 17.2- | Adding Transactions to Projects | |

| Lesson 17.3- | Creating Estimates | |

| Lesson 17.4- | Changing the Term Estimate | |

| Lesson 17.5- | Copy an Estimate to a Purchase Order | |

| Lesson 17.6- | Invoicing from an Estimate | |

| Lesson 17.7- | Duplicating Estimates | |

| Lesson 17.8- | Tracking Costs for Projects | |

| Lesson 17.9- | Invoicing for Billable Costs | |

| Lesson 17.10- | Using Project Reports | |

| CHAPTER 18- | Time Tracking | |

| Lesson 18.1- | Time Tracking Settings | |

| Lesson 18.2- | Basic Time Tracking | |

| Lesson 18.3- | QuickBooks Time Timesheet Preferences | |

| Lesson 18.4- | Manually Recording Time in QuickBooks Time | |

| Lesson 18.5- | Approving QuickBooks Time | |

| Lesson 18.6- | Invoicing from Time Data | |

| Lesson 18.7- | Using Time Reports | |

| Lesson 18.8- | Entering Mileage | |

| CHAPTER 19- | Payroll | |

| Lesson 19.1- | Setting Up QuickBooks Online Payroll and Payroll Settings | |

| Lesson 19.2- | Editing Employee Information | |

| Lesson 19.3- | Creating Pay Schedules | |

| Lesson 19.4- | Creating Scheduled Paychecks | |

| Lesson 19.5- | Creating Commission Only or Bonus Only Paychecks | |

| Lesson 19.6- | Changing an Employee’s Payroll Status | |

| Lesson 19.7- | Print, Edit, Delete, or Void Paychecks | |

| Lesson 19.8- | Manually Recording External Payroll | |

| CHAPTER 20- | Using Credit Card Accounts | |

| Lesson 20.1- | Creating Credit Card Accounts | |

| Lesson 20.2- | Entering Charges on Credit Cards | |

| Lesson 20.3- | Entering Credit Card Credits | |

| Lesson 20.4- | Reconciling and Paying Credit Cards | |

| Lesson 20.5- | Pay Down Credit Card | |

| CHAPTER 21- | Assets and Liabilities | |

| Lesson 21.1- | Assets and Liabilities | |

| Lesson 21.2- | Creating and Using Other Current Asset Accounts | |

| Lesson 21.3- | Removing Value from Other current Asset Accounts | |

| Lesson 21.4- | Creating Fixed Asset Accounts | |

| Lesson 21.5- | Creating Liability Accounts | |

| Lesson 21.6- | Setting the Original Cost of the Fixed Asset | |

| Lesson 21.7- | Tracking Depreciation | |

| CHAPTER 22- | Equity Accounts | |

| Lesson 22.1- | Equity Accounts | |

| Lesson 22.2- | Recording an Owner’s Draw | |

| Lesson 22.3- | Recording a Capital Investment | |

| CHAPTER 23- | Company Management | |

| Lesson 23.1- | Viewing Your Company Information | |

| Lesson 23.2- | Setting Up Budgets | |

| Lesson 23.3- | Using the Reminder List | |

| Lesson 23.4- | Making General Journal Entries | |

| CHAPTER 24- | Using QuickBooks Tools | |

| Lesson 24.1- | Exporting Report and List Data to Excel | |

| Lesson 24.2- | Using the Audit Log | |

| CHAPTER 25- | Using QuickBooks Other Lists | |

| Lesson 25.1- | Using the Recurring Transactions List | |

| Lesson 25.2- | Using the Location List | |

| Lesson 25.3- | Using the Payment Methods List | |

| Lesson 25.4- | Using the Terms List | |

| Lesson 25.5- | Using the Classes List | |

| Lesson 25.6- | Using the Attachments List | |

| CHAPTER 26- | Using Help, Feedback, and Apps | |

| Lesson 26.1- | Using Help | |

| Lesson 26.2- | Submitting Feedback | |

| Lesson 26.3- | Extending QuickBooks Online Using Apps and Plug-ins |

QuickBooks Online Training Course Overview

Intuit‘s QuickBooks is the most popular small business accounting software on the market today. During this 10.5 hour QuickBooks Online video training course, our expert instructor will show you how to set up a QuickBooks Online company file, pay employees and vendors, create custom reports, reconcile your accounts, use estimating, time tracking and much more. This QuickBooks Online training course covers the same material as our two-day classroom training and was designed to provide a solid foundation in QuickBooks Online.

Course includes video lessons, printable instruction manuals, a practice exam with evaluative feedback (find out why your answers are right or wrong), your final exam submission, and a course certificate of completion.

At TeachUcomp, Inc., you choose how you want your QuickBooks Online training delivered.

Online subscriptions offer the most flexibility and value. With online training, you can access your courses anytime and anywhere you have an internet connection (including all new releases and updates). Your subscription grants you instant access to ALL of our courses for one low price. There are no contracts and you can cancel at any time. You may choose between a monthly or annual plan.

Courses are also available individually via digital download and online for a one-time charge.